The Board of Library Trustees approved the library’s 2020 budget at its October 2019 meeting, setting clear priorities to address building and IT infrastructure and maintenance needs and to achieve greater wage and salary equity. More background:

- From tax years 2009 through 2019, the library’s actual growth rate is 2.37%, according to data from the Cook County Clerk’s Office and Cook County Treasurer’s Office. See a year-by-year comparison »

- Drafts of the 2020 library budget were discussed at the August and September library board meetings.

- Following state law as a village library, the library’s 2020 budget was submitted after Library board approval as a levy resolution to the Village of Oak Park.

- Please find all board agendas and meeting minutes at oppl.org/board, including the library board-approved 2020 budget (pdf) »

How does the 2020 library levy request break down?

| Total Levy Request | 2019 fiscal year (2018 tax year) | 2020 fiscal year (2019 tax year) | Change (year over year) |

| Property Taxes Paid into TIF districts | N/A | $693,144 | N/A |

| Operating Budget | $8,328,248 | $8,578,095 | +3% |

| Bond Debt | $1,075,734 | $1,070,807 | 0% |

| TOTAL | $9,403,982 | $10,342,046 | 10% |

Why is this breakdown important to consider?

Taxpayers will not pay 10% more to the library. This is because most (7%) of the library’s 2020 levy request is related to TIF district appropriation. TIF tax dollars have already been collected by the Village as part of previous 20 years’ assessed valuations. Here’s more about how TIFs work »

How will what I pay to the library as a portion of Oak Park property taxes be affected?

This is still to be determined, since it relates to the overall Village budget and levy process. Previously, Oak Park property owners have paid about 4.8% of their total Cook County property tax bill to the library. Read more about the Village of Oak Park budget »

How does the library intend to use the money?

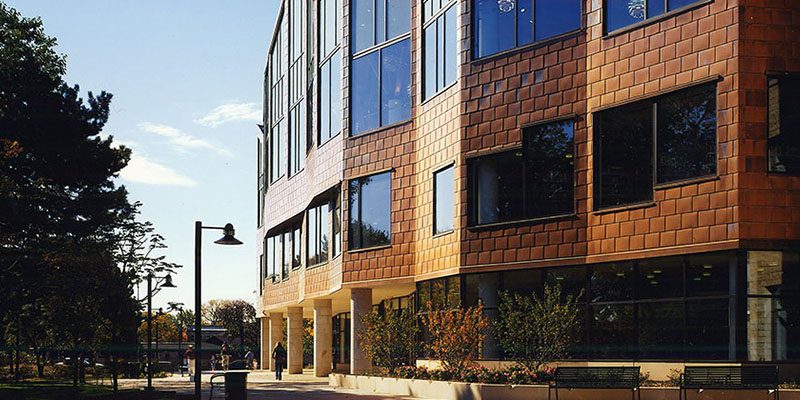

The library’s 2020 levy request prioritizes significant capital needs as enumerated in our capital assets study on the 16-year-old Main Library building.

As good stewards of the community’s investment in two library buildings (Main Library and Maze Branch), the library developed budget projections through 2025 based on the study. (To note, first floor space is rented at Dole Center from the Park District of Oak Park to house the Dole Branch Library.)These projections enable the library to plan ahead for large, necessary capital expenses while maintaining a fund balance to pay for the continued care of heavily used public facilities and spaces.

Through 2025, examples of budget projections for necessary capital projects include:

- $6.6 million (through 2033) for Main Library HVAC systems

- $690,000 for Main Library sanitary, storm, and vent maintenance

- $289,000 for Main Library and Maze Branch security systems

- $208,000 for Main Library telcom cable infrastructure

- $55,000 for Maze Branch Library tuck pointing

Funds also are designated to achieve greater wage and salary equity (as pay was below national industry averages), to meet minimum wage requirements, and for continuing development of information technology infrastructure, community engagement services, and digital content, such as online databases and ebooks.

Explain how a TIF allocation works.

- Here’s more about how TIFs work. And here’s what we know, simplified.

- When a TIF district begins, the library’s portion of the assessed valuation within that district is frozen.

- Any increase in the valuation of the properties within the district is still taxed at the same rate for property owners.

- The Village continues collecting tax revenue from the increases within that district to put back into those districts for economic development.

- When a TIF district ends, the Village no longer captures the revenue from the growth within the district.

Which means: “Ultimately, after the conclusion of the TIF project, all of this new revenue growth is available to the various taxing bodies. Successful TIF investment therefore serves all of the investors, both public and private. Private investors are helped by a reduction in development cost and risk, and public investors by the generation of additional revenue available at the conclusion of the TIF project.” — Source: “Tax Increment Financing Return on Investment and Impact Report” prepared by S.B. Friedman & Co.

Want to learn more?

Please feel free to contact Board of Library President Trustees Matthew Fruth at m.fruth@oppl.org or Director of Operations Jeremy Andrykowski at jeremya@oppl.org.